MISSION

Power to the imagination

Spiral Capital supports entrepreneurs who are transforming society with the power of imagination and technology.

We work together with entrepreneurs to create a vortex of change, as we sweat and muddle together.

WHAT WE DO

00

Overview

Spiral Capital manages VC funds (general venture capital fund) that invest across technology sectors, with LPs of various corporates and institutional investors.

Spiral Innovation Partners manages SVC funds (sector-focused venture capital funds) that focus on specific investment areas and provides comprehensive open innovation support services to LPs of funds managed by the Spiral Capital Group.

01

VC Fund

We invest in and provide a wide range of hands-on supports for startups by leveraging the outstanding knowledge and extensive networks of our capitalists.

Funds managed by Spiral Capital

- Fund Name

- Spiral Capital Japan Fund Ⅰ

- Est. Year

- 2016

- Fund Size

- JPY 7 billion

- Limited Partners

- Corporates, Institutional Investors

- Number of Investments

- 34 companies (completed)

- Investment Sectors

- Across internet sectors, with focus on X-Tech

- Fund Name

- Spiral Capital Japan Fund Ⅱ

- Est. Year

- 2019

- Fund Size

- JPY 10-15 billion (target)

- Limited Partners

- Same as the leftSame as the top

- Number of Investments

- In process

- Investment Sectors

- Same as the leftSame as the top

Investment Policy

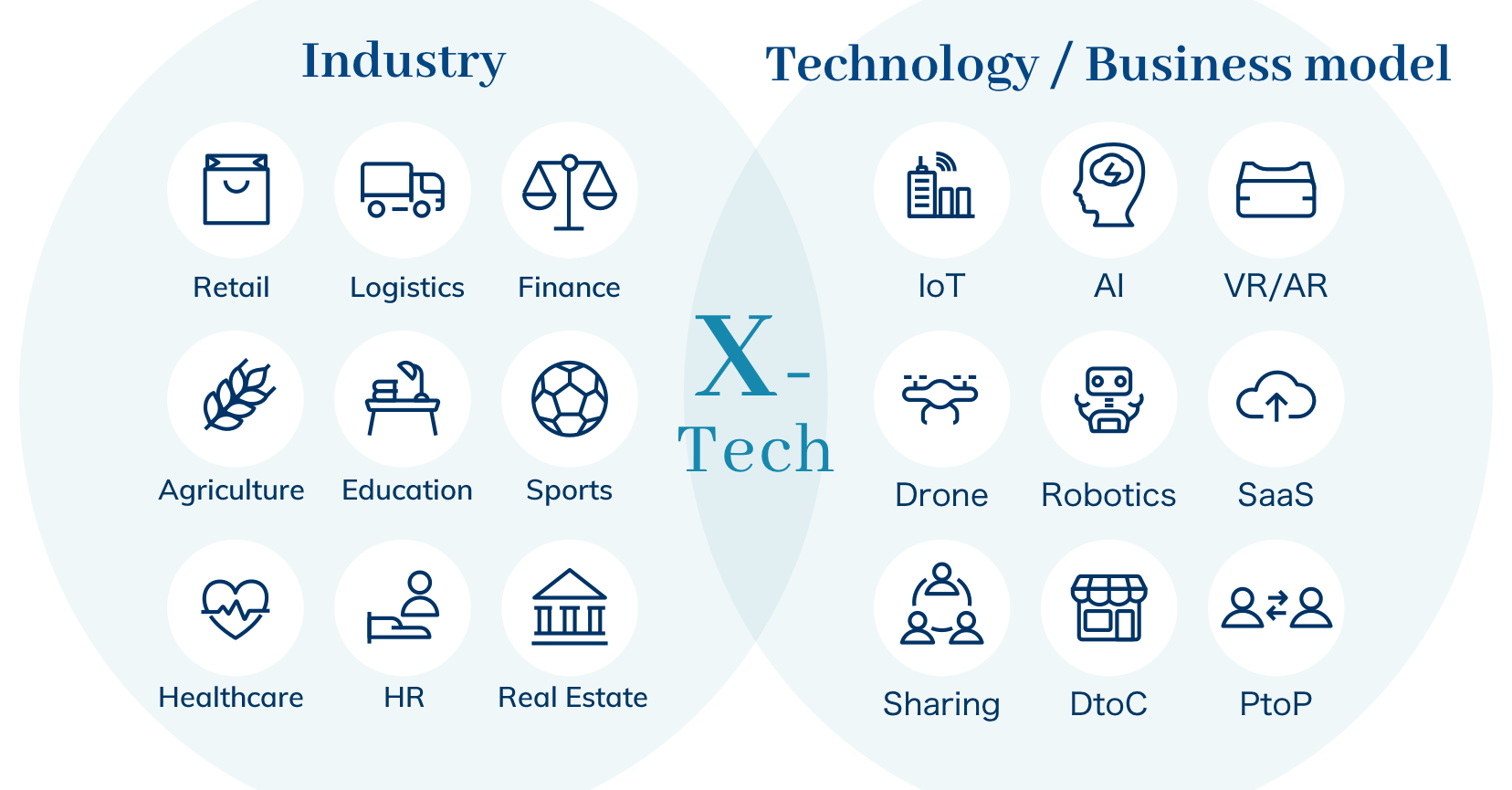

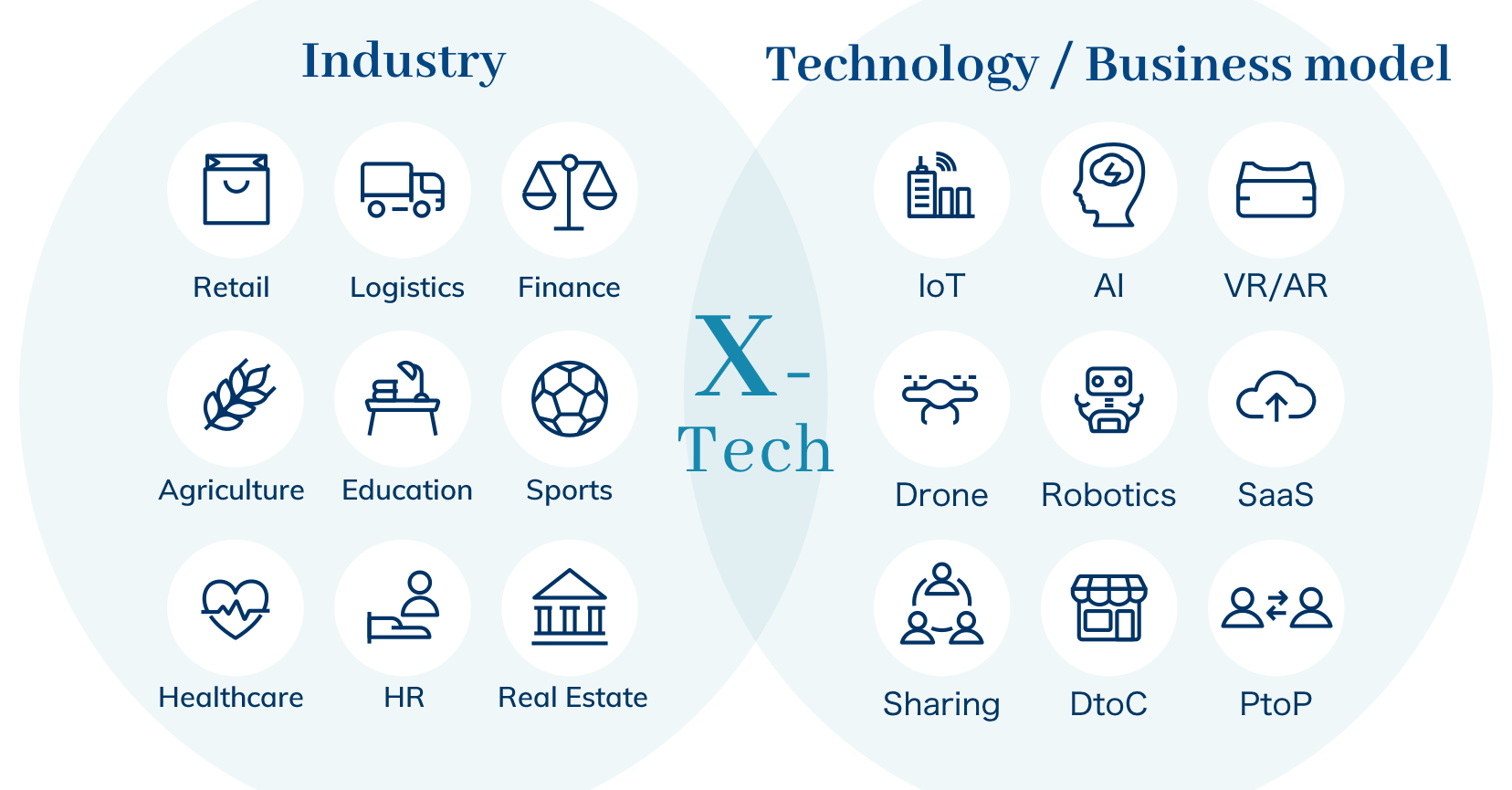

Investment Areas

While covering the entire Internet/technology domain, we invest in a wide range of startups with a focus on X-Tech (fusion of the Internet and the real world). The two main areas of investment are: (1) "industry transformation businesses" that solve problems faced by existing industries, and (2) "new industry creation businesses" that create new industries using leading-edge technologies and business models.

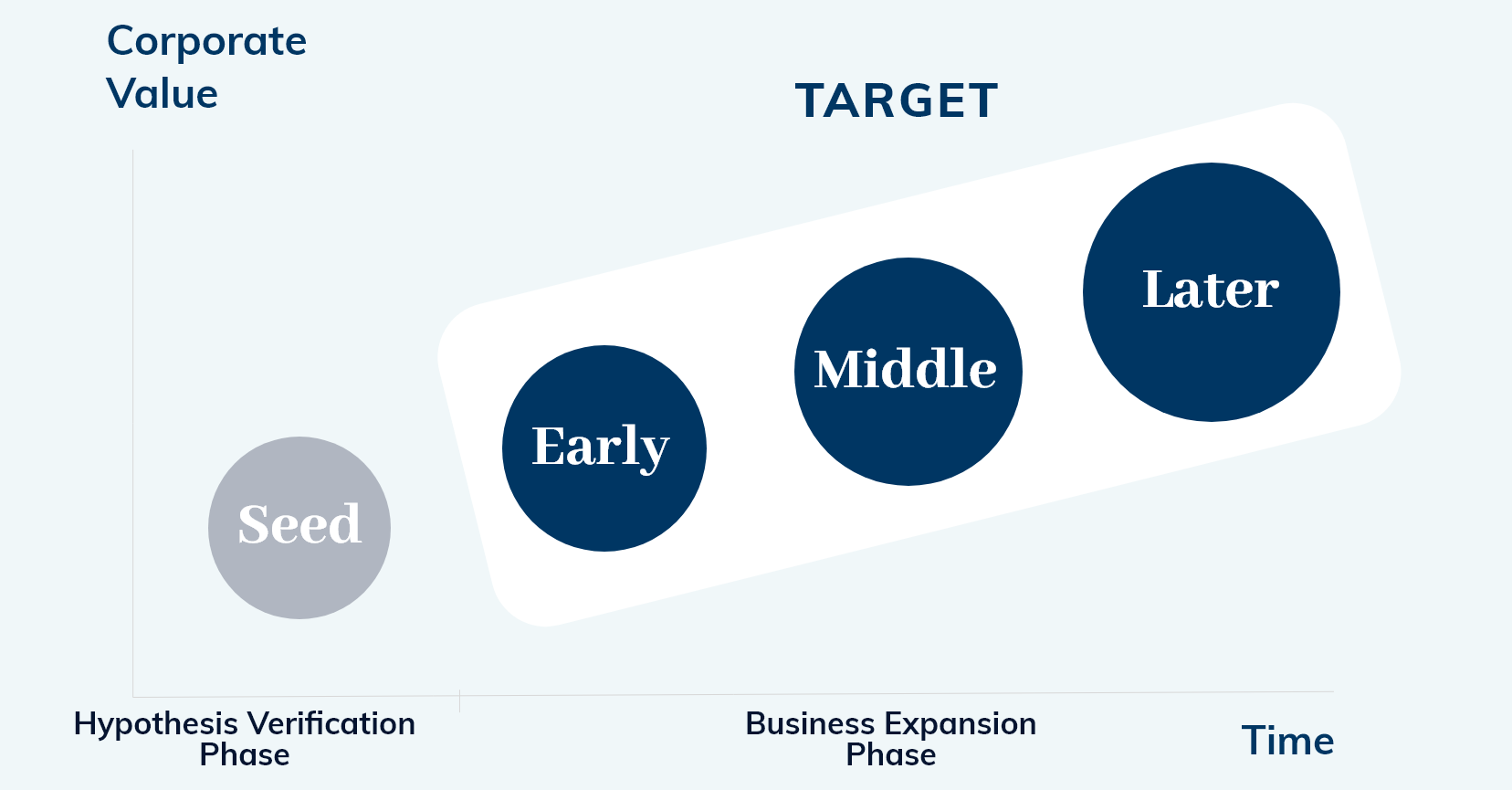

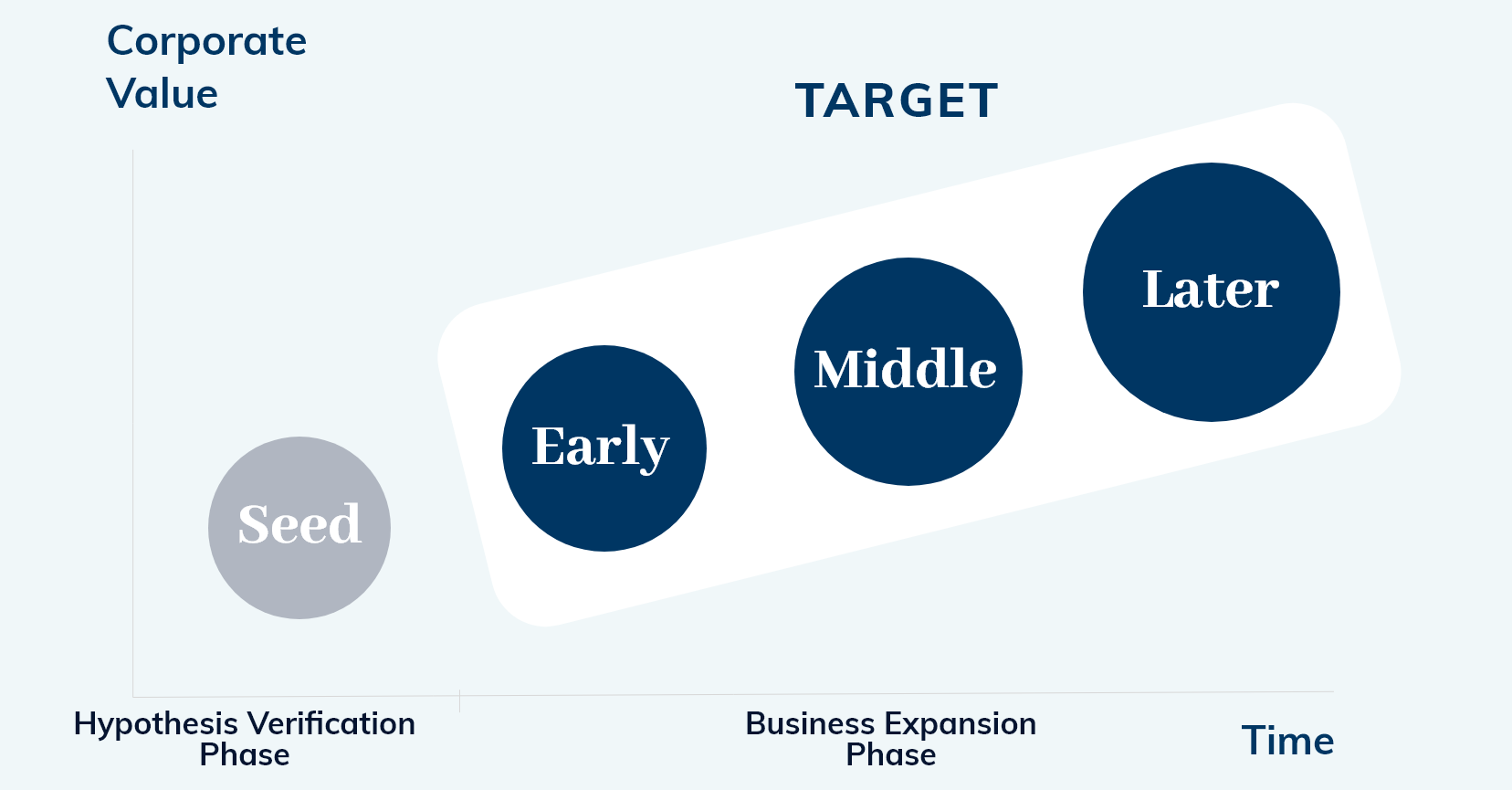

Investment Stages

We invest in early-stage and later startups that have passed the hypothesis verification phase and are moving into the business expansion phase. After the initial investment, additional investments can be made in subsequent rounds depending on the situation.

We aim to invest 100 to 500 million yen for early-middle stage startups and 500 to 1 billion yen for later stage startups.

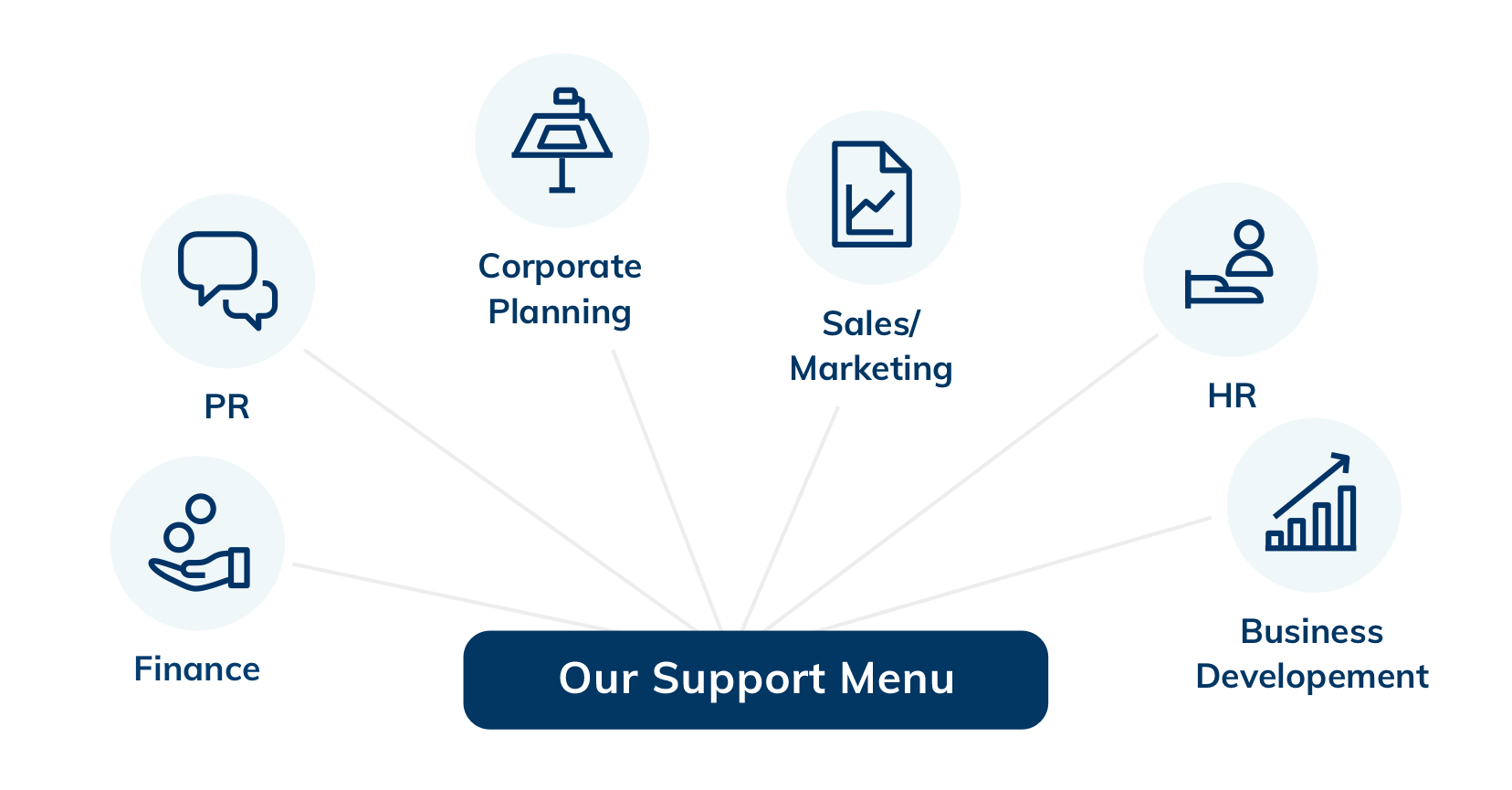

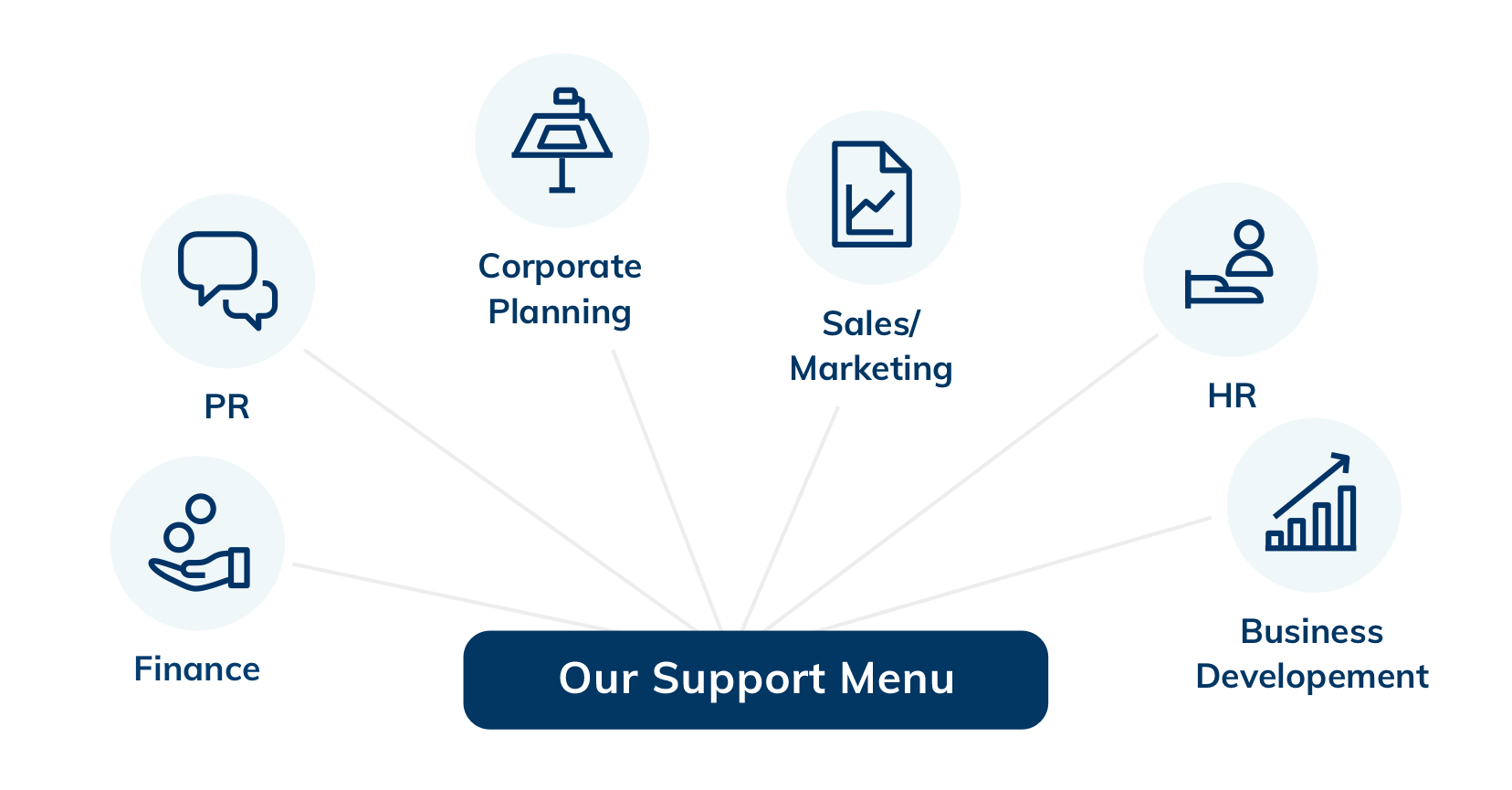

Hands-on Support

We provide a variety of management support to our portfolio companies. We support our portfolio companies to increase their value by collaborating with external partners as necessary.

02

Open

Innovation Support

Through Spiral Innovation Partners, we provide comprehensive support for the promotion of open innovation.

COMPANY PROFILE

Address

Azabudai Hills Garden Plaza B 504, 5-9-1, Toranomon, Minato-ku, Tokyo, 105-0001, Japan

Business

Management of VC funds

Representative Partner

Tomokazu Okuno

Telephone

+81-3-6452-8615

contact-sc@spiral-cap.com

POLICY

Spiral Capital Group

DE&I Policy

2025.3.31

1. Background: Why We Value DE&I

Our firm recognizes that Diversity, Equity, and Inclusion (DE&I) play a crucial role in creating a sustainable society and are essential for corporate growth. As a member of the venture community, we are committed to fostering DE&I in all aspects of our operations.

2. Our Goals for Advancing DE&I

To realize DE&I, our firm aims to promote the following initiatives:

- Demonstrating and communicating DE&I through leadership

- Fostering a psychologically safe and inclusive organizational culture

- Recruiting and developing diverse talent

- Ensuring transparency

- Systemically addressing unconscious bias

- Providing education and training on DE&I

- Conducting regular evaluations and feedback

3. Toward the Eradication of Harassment

Harassment is a serious human rights issue, and our firm absolutely does not tolerate any form of harassment against officers and employees within our firm or at our portfolio companies and prospective investee companies.

To eradicate harassment, we will implement the following measures:

- Establishing policies that do not tolerate harassment or any form of discrimination

- Clearly demonstrating leadership’s commitment to eliminating harassment

- Building a safe system for whistleblowing and reporting, and ensuring its fair operation

- Providing education and training aimed at eliminating harassment and discrimination